Flow

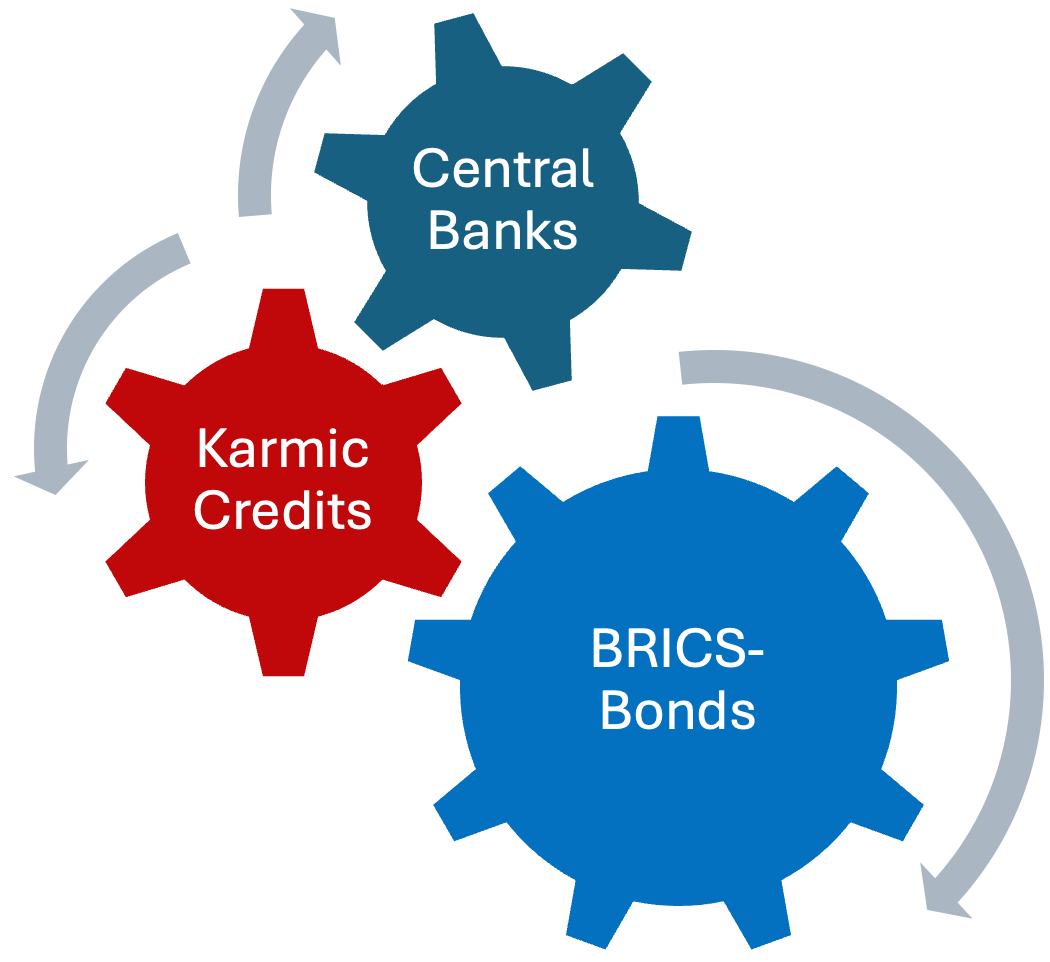

Karmic credits are regenerative. 275,000 credits are born when an account opens, and it dies when the balance attempts to go past its 6-digit limit. There are no interest, fees or charges, nor do we offer periodic payments or loan facilities, but we do provide a 6500 credit monthly top-up that works like a lifetime wage.

Karmic Credits holds no fixed value - yet it is pegged 1 to 1 in every country to provide the people with continuity and restore trade and living conditions. Even though the IMF still holds relevance, Karmic Credits provides a real pathway for all countries to ditch their western created value and equalize immediately or over time.

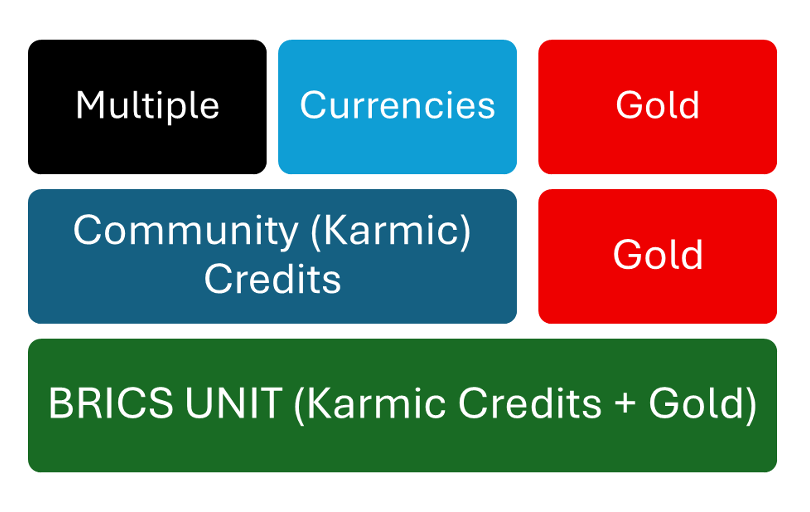

The BRICS Unit is multipolar and the problem of trading massive numbers to settle through 60% local currency and 40% gold by weight, allowing Sovereign Nations to trade with one another fairly. The sooner Sovereign Nations equalize their currencies, the easier it will be for people to cross the globe using the same basic currency to ensure stability throughout the world.

BRICS -Bonds are not related to the debt-based idiology. They are Collective measures managed by BRICS to provide a service to help reduce a countries national debt for a time through their uptake. Should a country want out - the bonds freely given can be returned in the bond equivalent of gold, silver, cash or land, back to the people - a simple "money in money out" arrangement.

BRICS-Bonds on Governments

- Efficient Financial Operations

- Limits on bond allocation are based on population numbers to ensure fair and equitable distribution.

- Sovereign central bank allocations are managed and must be replaced, promoting development spending while reducing long-term debt burdens.

- Karmic credits are responsive with no interest fees, periodic payments, or loans, making financial processes simpler and stress-free.

- Economic and Social Benefits

- This framework eradicates poverty and hardship, and ensures resources are better managed and utilized.

- It promotes local trade and improves lives and livelihoods, fostering economic stability and growth.

- Encouraging Government Accountability

- Governments are no longer responsible for people’s health, social security and welfare, nor do they need to offer aid packages.

- Governments will be fully responsible for their term in office, changing the dynamics of the politician - lobby interaction.

- Global Stability and Collaboration

- By emphasizing ethical imperatives and fostering inclusivity, the framework strengthens trade relationships and enhances trust in new financial markets.

- The shift from financial markets, shares and commodities, to collective needs promotes social equality and encourages economic security.

Overall, the framework not only supports efficient financial management and governance but also revitalises communities, reduces social disparities, and promotes peace and prosperity.

BRICS and the role of Gold

Gold provides intrinsic value and security, mitigating the risks of unstable financial markets. Vulnerabilities in fiat currencies led BRICS to use gold (1kg = 100,000 USD) in 60/40 settlement arrangements for a universally recognised exchange unit. However, integrating Community (Karmic) Credits as a replacement for fiat vulnerabilities offers collective stability, potentially eliminating the need for gold in future trade settlements.

This framework completes the multipolar BRICS strategy for addressing global monetary and governance challenges. By focusing on responsible resource management and ethical practices, it strengthens domestic economies and promotes broader integration of national interests. The ultimate goal is a collective model that benefits all humanity and eliminates mistrust.

As the world transitions from unipolar to multipolar systems, no single country desires the burden of reserve currency status. While China is being pushed towards this role and the US is reluctant to relinquish it, the collective approach would allow BRICS members to shoulder this responsibility in the best interests of humanity, striving for a stable, war-free financial system.

Financial Markets: the Path Forward

Adopting Community (Karmic) Credits on a country-by-country basis offers a global financial framework that addresses both individual and corporate needs. This needs-based and debt-based approach is particularly relevant as AI and robotics replace many jobs, making government support less critical and reducing individual reliance on superannuation for retirement.

Financial markets are undergoing rapid changes: bond markets may see bursts without buyers, share markets rely on machine trading, derivatives are shifting liabilities to super funds, and currency, gold, and tariff wars are all nearing critical points. Humanity stands at a crossroads, with the opportunity to embrace new possibilities, innovations, and a future that was once only imagined.

The choice is ours—to repeat history or to move forward towards a new world of opportunity and hope.